DEXSOLIDE makes investment education available to anyone by connecting them with investment education companies. These companies share basic and advanced investment training with people via the internet.

The DEXSOLIDE website is open 24/7 for registration and connection with investment tutors worldwide. DEXSOLIDE is accessible to and inclusive of people of different races, genders, religions, careers, and beliefs, fulfilling the dream of acquiring investment education for numerous people.

To fulfill their dreams with DEXSOLIDE’s help, people should register on the website by correctly submitting their names, email addresses, and phone numbers. DEXSOLIDE will instantly connect them with investment education firms that will complete their registration process via phone and provide their login credentials to start learning.

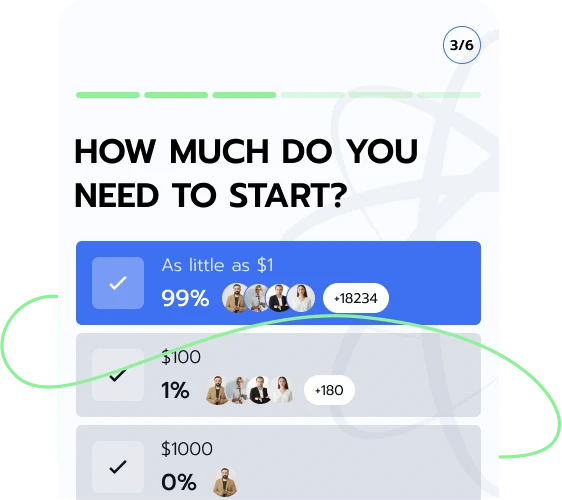

DEXSOLIDE is free of charge and navigable. The website is a convenient alternative to the stress of searching the internet for an investment tutor. DEXSOLIDE uses a quick connection process to bring users together with suitable investment education firms.

As DEXSOLIDE invites people from different cultural or racial backgrounds to register, it connects them with investment education firms that teach in diverse languages.

Investment teaching is not only done in English. Therefore, people are not under compulsion to be native English speakers or take English classes before registering. Register for free on DEXSOLIDE to connect with investment tutors.

Investment students are free to choose their areas of interest. There is no one-size-fits-all learning curriculum for all students.

Students can also request customized curriculums based on their jobs, careers, and personalities and choose study sessions that fit into other plans. Get a customized study plan and time by registering on DEXSOLIDE.

To connect with investment education companies, prospective investment learners must register on DEXSOLIDE.

People must ensure these details are correct while registering on DEXSOLIDE by submitting their names, emails, and phone numbers. No letter, digit, or symbol must miss or be wrongly positioned.

Once people submit the correct personal details, DEXSOLIDE will connect them with investment education companies immediately. Connect with one instantly by signing up on DEXSOLIDE.

Anything a person allocates resources to try for gains can be considered an investment. In some cases, the person generates losses due to risks, including inflation, government policies, declining market value, wrong decision-making, and volatility in market prices.

Some assets that investors choose are bonds, stocks, cash or cash equivalent, real estate, and commodities. These assets have different features, advantages, and risks. Investors often diversify to reduce overall risk impact. Register on DEXSOLIDE to learn more from investment tutors.

Market value shows a company’s or an asset’s worth in the financial market. On the other hand, market price is an asset’s exchange price. Meanwhile, market value can also be the market price when there is a fair market. Below, we discuss the conditions for a fair market:

Mutually agreed price shows that trading parties must not be forced to transact and must agree on the final buying/selling price. The ‘no distress’ condition dictates that both parties involved in an asset exchange must not hurry to finalize the transaction as it may cause wrong decision-making not reflective of a current market situation.

Investors should keep a close eye on the market and analyze situations to make informed buying and selling decisions. Market value is expressed in market value per share, book value per share, market/book ratio, price-earnings (P/E) ratio, and earnings per share. We briefly discuss them below:

Market Value Per Share

It is calculated by determining a company’s market value and dividing it by its total outstanding shares.

Book Value Per Share

It is determined by dividing a company’s equity by its total number of outstanding shares.

Market/Book Ratio

Market/Book ratio calculates a company’s market and book value ratio.

Dividing the company’s market value per share by the book value per share gives this ratio. A market/book ratio can either be high or low.

P/E ratio is a company’s share price to its earnings per share. A high value shows that the company’s shares are overvalued. That is, investors project the company’s earnings to increase. When the company’s P/E ratio is low, the company is undervalued, and investors believe the company’s earnings will reduce. Register to learn more.

When DEXSOLIDE connects people to investment education firms, they will learn different ways to calculate market value - income, assets, and market approaches. The income approach has two methods - capitalized earnings and discounted cash flow (DCF). Capitalized earnings calculate the worth of an asset that may generate stable income.

In the capitalized earnings method, the ratio of the net operating income generated for a period and the asset’s capitalization rate is taken. Discounted cash flow projects future cash flow and discounts it to reach its current value based on associated risks and prevailing interest rates. With the assets approach, the fair market value is derived by summing up a company’s adjusted assets and liabilities. The value of net adjusted results is obtained by calculating the difference between the fair market value of the assets and liabilities.

Market approaches involve business value evaluation and precedent transactions. A business’ value can be evaluated by comparing all businesses operating on the same scale in an industry. Precedent transactions use past prices paid for a company as a reference, especially in merger and acquisition transactions. Register on DEXSOLIDE to learn more from investment education companies.

In finance, data points or ratios measure and analyze a company’s ability to make returns. The focus is on what’s left after deducting costs such as shareholders’ equity, operating costs, and balance sheet assets for a certain period. Investors often focus on companies with higher ratios. Such figures may indicate a healthy investment option.

The two main categories of performance metrics are margin and return ratios. The margin ratio depicts a company’s ability to gain from sales, while return ratios show its ability to generate shareholder returns. Subtypes of margin ratio are cash flow, gross, net, and EBITDA margins. Return ratios are return on equity, invested capital, and assets. We discuss a few of them below:

This metric shows a business’ ability to convert sales into cash. The margin represents the difference between a business’ cash flow from operating activities and sales generated. Insufficient cash flow would require a company to borrow or raise funds through investors, while a low percentage of cash flow might represent loss despite a company’s sales. A high cash flow suggests that a company has enough cash to settle operating costs.

Operating gains margin is the sales percentage before subtracting income taxes and interests. This margin reveals a company’s management strength in managing operating costs. High operating costs in companies can cater to fixed costs and may help them pull through during terrible economic situations.

ROA is a company’s after-tax returns generated for every dollar of assets held. The ROA margin shows the percentage of a company’s net earnings relative to its total assets and measures a business’ asset intensity. A company is highly asset-intensive if it earns lower gains per dollar of its assets. These companies require huge investments to buy equipment to generate income.

ROE shows a business’ net income percentage relative to stockholders’ equities. A high ROE shows a company’s capacity to refrain from debt financing and encourages people to buy its stock. To learn more about assessing investment options, register on DEXSOLIDE to connect with investment education firms.

Asset prices are rarely stable. Comparing price fluctuation relative to expected returns over a period measures its volatility. A high volatility represents a high risk in investments. Types of volatility are market, historical, implied, and price. Market volatility measures the difference in investment prices due to the bearish or bullish state of investment markets like stock, forex, or bond markets.

Historical volatility considers an asset’s current price movements based on fluctuations within the past 12 months. Implied volatility relies on computations to determine investors’ or the market’s decision on what price fluctuation to expect. Price volatility is the unstable demand and supply movements that affect prices.

Investors often spread their capital across different assets to limit risk exposure on a single asset. When building a diversified portfolio, they consider potential risks, liquidity, industries, and risk tolerance.

Strategies for portfolio diversification are international, asset class, and individual diversification. International diversification involves owning assets in foreign countries with different market conditions or investment policies.

Asset class diversification invests in assets in different classes, such as bonds, stocks, cash, and alternatives. On the other hand, individual diversification invests in several assets within a class. An investor might choose to diversify individually by buying different stocks or alternatives.

Debt financing is selling fixed-income products to raise capital. These products include treasury bills, certificates, notes, bank loans, and bonds. Short-term debt financing may be used to generate capital to cover operating costs, while it may be used long-term to finance capital-intensive projects. While this financing mode preserves company ownership, it can lead to bankruptcy.

Cash instruments are easily transferable and valued by the cash used to buy or sell them.

Derivative instruments (options, forwards, futures, swaps) derive value from underlying assets like currencies, commodities, and bonds.

Money market instruments are short-term financing instruments - commercial papers, treasury bills, and certificates of deposit - to increase a business’ liquidity.

Foreign exchange instruments - options on currency pairs and contracts for difference - are traded on currency markets like forward forex, spot forex, and futures forex markets.

Equity instruments include preferred and common stock. These instruments represent ownership in a business and confer voting and earning rights to holders.

Debt instruments are used to raise funds where the borrower pays the principal with interest to the lender.

Get a clearer perspective of investment through education. Gain advanced knowledge, engage in highly cerebral conversations, and get a widened intellectual scope by registering on DEXSOLIDE to connect with investment tutors.

Begin this journey by clicking the sign-up button and providing the requested information - names, email addresses, and phone numbers.

| 🤖 Cost to Join | Sign up at no cost |

| 💰 Service Fees | Absolutely no charges |

| 📋 Enrollment Process | Quick and easy sign-up process |

| 📊 Learning Areas | Training on Crypto, FX Trading, Equity Funds, and More |

| 🌎 Regions Served | Serviceable in almost all nations but not in the USA |